One of the most used TRICKS Life Insurance Agents use to fool potential clients

Sounds too good to be true?

It probably is…

Have you been looking for life insurance and been quoted so much lower than everyone else that it sounded too good to be true?

Watch out… you may have an unethical agent on your hands!

The following is a VERY TYPICAL TRICK that some VERY UNETHICAL AGENTS use to CON potential clients.

For example only I’ll use XYZ Insurance Company.

Say you speak to three insurance brokers and all three gave you a price for $50.00 per month for $30,000 in coverage from XYZ Insurance Company.

Then you get a new quote from a fourth insurance broker for $54.00 per month for $60,000 in coverage from the same XYZ Insurance Company.

The obvious choice would feel like the $54.00 per month for $60,000 is the best most cost effective choice.

Why did the other three agents quote $50.00 for $30,000 and the fourth quote $54.00 for $60,000?

Were the first three just being greedy??

How life insurance agents find your quote.

Life insurance agents typically use a quoting tool with the approved carriers they represent to find the best policy for you based on the information provided by the client.

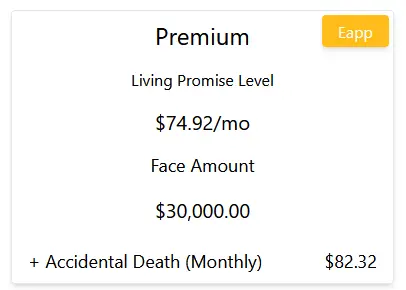

This is how it typically looks to the agent.

In this example the quote is $74.92 for $30,000 in coverage.

What you see below the $30,000 is an accidental coverage add-on for $82.32.

What the additional accidental coverage means is IF you pass in an accident you will get double the payout on the policy.

So IF you were to pass in an accident and you had the additional accidental coverage your payout would be $30,000 for the face value of the policy, then an additional $30,000 for the accidental, making the total payout $60,000.

However if you DID NOT pass in an accident and you had the accidental coverage, your payout would only be $30,000.

What an UNETHICAL sales agent may do based on the example above is quote you $82.32 for $60,000 in coverage NEVER MENTIONAING that $30,000 of that is ONLY if you pass in an accident.

MOST people do not find this out until they need to cash out the policy.

Insurance agents FACTS

Life insurance agents have ABSOLUTELY NO CONTROL over the carrier’s prices.

They are appointed by the carriers to sell their policies to clients looking for life insurance.

The only variation may be they did not enter as many details in the quoter tool as the other agent making the price from the same carrier slightly different.

Unless the quote is a few months old the numbers should be very similar to the other quotes you have received from the same carrier.

Example: XYZ Insurance Company (carrier)

Quoted in April 2025

$50.00 for $30,000

$53.00 for $30,000

Quoted in December 2025 after a birthday

$58.00 for $30,000

$63.00 for $30,000

Insurance agents are there as an ethical guide to steer you through the process, be on your side, and be there when it’s time to cash in on the policy, not to try and trick you with cheap tactics.

Tips on getting quotes from an Insurance agent

- If your quote is extremely different from the same carrier (XYZ Insurance Company) make sure you ask your agent how much coverage is for the face value, and how much coverage is for accidental.

- Ask to see the policy printed out and emailed to you.

- Ask a friend or relative to look over the policy.

- Get free legal advice and have a lawyer look over your policy.

- Call the carrier itself and ask them to explain the coverage.

- Contact us and have us look over your policy FREE OF CHARGE

We are here to help.

If you feel like you are being taken advantage of please give us a call or reach out by email and we can look at your policy and speak with you about the FACTS of your coverage.

You should never have to deal with tricks from slimy agents when trying to protect your family.

Here’s to your love & life!

All the best

Extensive Family Life

Have Questions?

Or Call

866-575-7566

Reach Out Today

Get a Quote Now For Your Life Insurance!

Requesting a quote won’t flood your phone—we respect your time and privacy.

No aggressive calls, just honest help from a trusted life insurance broker.

By clicking “Get Quote Now,” you acknowledge that you’ve read and agree to our privacy policy. You also give permission for a licensed insurance agent to contact you via phone call, email, or text/SMS at the number and email address you provide. These communications may be made using automated technology. Your consent is not required to make a purchase. You may opt out at any time by replying “STOP.”